Rhythms for Organizations

Rhythms: The most important thing about your organization –

you may not understand.

By: Ken Sutterfield, Senior Consultant / Hueston Consulting Group / ken.sutterfield@gmail.com

Organizational rhythms have a fundamental effect on the success of an individual and an organization. Rhythm is not something you decide or is defined by any one person in your organization. It is defined by external and internal synergies we share space with.

We don’t often think about it, but life is based on natural, recurring rhythms: Days, years and even our own lives have predictable cycles that allow us to navigate through time. Our morning activities differ from our evening ones; we plan vacations around the seasons; and we focus our energy according to the stages of our careers. Without these cadences the music of life would be chaotic, and it would be hard to build a common social experience with other people.

The turning of the calendar is a reminder that organizations also need rhythm. Some of it derives naturally from the sun and the moon, financial reporting requirements, and the specific nature of your organization. But leaders need to provide the rest of the music to give donors, employees, and constituents a sense of consistency. From my experience, there are at least three types of cadence that leaders need to create:

Planning and Budgeting: First, leaders need to make sure that an effective planning and budgeting cycle is in place at an organization level. This is the cadence that forces people to set strategies and goals and translate them into plans. Gauging the right timing for this cycle and how much detail it requires is almost always a challenge, and many organizations stumble trying to get it right (or perfect).

Reporting and Pivoting: People at all levels value rhythms for assessing progress and making improvements to achieve their goals. But this rhythm often breaks down due to lack of discipline, transparency, or the avoidance of tough discussions when things get off track. In fact, a common reason that companies struggle with execution is that the “reporting and pivoting” cadence includes too much improvisation, which means that problems are addressed too late or not at all.

Human Resource Staffing and Development: At an organization-wide level, this means identifying needed skills and resources, closing gaps between current and future needs, moving people to appropriate roles, and rewarding or recognizing people for success. Within various areas, this rhythm also includes periodic recalibration of unit structures, disciplined performance feedback, mentoring, coaching, and training. Again, while many organizations have yearly cycles for these activities, they are toooften viewed as one-time reporting exercises rather than part of an ongoing rhythm. However, many squeeze them into the calendar as ad-hoc tasks when a problem arises.

Look for rhythms in behavior of your constituencies, Look for unexpected spikes or interest in a certain area. Be curious and allow yourself to think creatively.

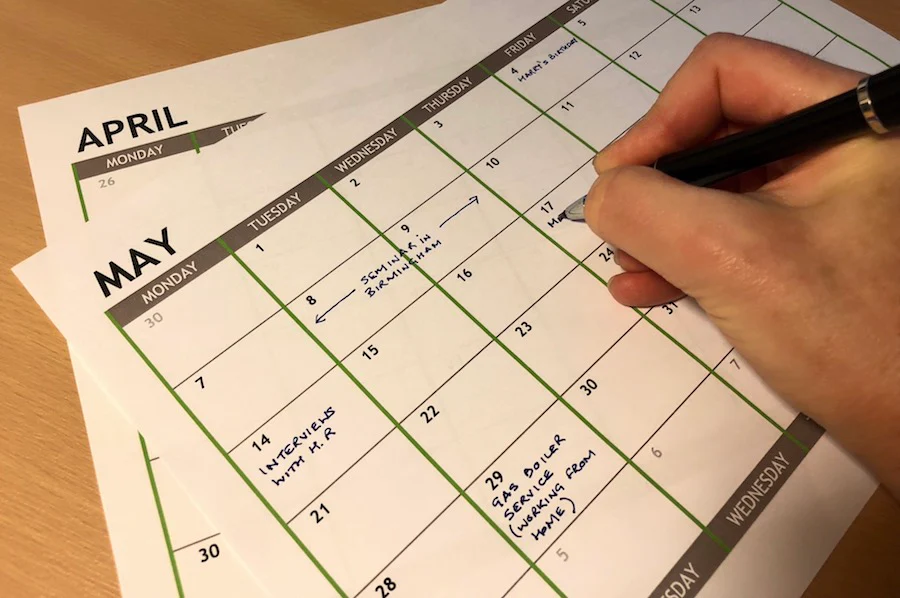

The best way to approach and understand your organizational rhythms is to create a “master calendar” for yourself and your team.

Mark (or estimate) all of the key dates and requirements that are part of the corporate process. Then put in the recurring notes that you require for your own rhythm: one-on-ones with direct reports, skip-level meetings, project reviews, mentoring sessions, team off sites, etc. Once you begin to see how it all fits together, you can make adjustments, do advance planning, and communicate frequently and specifically with your people.

Embrace your natural rhythms and stop swimming up stream and go with the flow.

It’s Time for Your Nonprofit to Shine (by Ken Sutterfield)

IT’S TIME FOR YOUR NONPROFIT TO SHINE

Ken Sutterfield

The beginning of a new year is the perfect time for your nonprofit to shine. There is no

better opportunity than after the busyness of November and December to take a

moment to communicate your appreciation to your donors for their partnership. Be

transparent and share the highpoints and yes - even your setbacks - with those who have

invested in your work.

While it is not an IRS requirement to receipt your donors by January 31, it is an

expected best practice of those who have supported your cause. Donors are expecting

your year-end Tax Statement so they can prepare their Tax Returns. There is absolutely

nothing worse for a nonprofit than receiving a call from a donor asking to receive

their statement. Taking the steps necessary to do this early and communicate

effectively will make you and your organization stand out. Additionally, thankfully the

IRS allows email statements as well as the standard mailed statement.

This time of year is a tremendous opportunity to communicate to your vested

constituency insights and needs that were possibly not met. A great opportunity to even

insert a soft ask. But…. most of all this is a Thank You Note expressing your

appreciation for their partnership and generous investment in your organization’s mission.

[The following is directly from the Internal Revenue Service web site.]

Charitable Contributions - Written Acknowledgments | Internal Revenue Service (irs.gov)

The written acknowledgment required to substantiate a charitable contribution of $250 or

more must contain the following information:

* Name of the organization;

* Amount of cash contribution;

* Description (but not value) of non-cash contribution;

* Statement that no goods or services were provided by the organization if that is the

case;

* Description and good faith estimate of the value of goods or services, if any, that the

organization provided in return for the contribution; and

* Statement that goods or services, if any, that the organization provided in return for

the contribution consisted entirely of intangible religious benefits, if that was the case.

Plan and implement the steps necessary to receipt and communicate with your donors by

January 31st each year. Your nonprofit organization will shine brightly and will create a lasting

impression that will endear your donors to you and your mission.

Calendar Planning by Ken Sutterfield

Planning and Execution: The importance of the Calendar in 2023

By Ken Sutterfield

I have worked in both very small organizations and very large organizations during my nonprofit career. I have always been mystified when there was a lack of yearly calendar planning or flat-out opposition to the process essential to our daily work and mission execution.

An established yearly calendar executed properly is the most basic and yet effective tool for any (CEO) Chief Executive Officer or (CDO) Chief Development Officer. The calendar provides an actionable story of the mission each day with goals and objectives coming to life within the rhythm of both those executing and those being impacted.

The calendar also keeps you and those you lead on track and inspires confidence in the plan as you prepare for, execute and meet the objectives. The executed calendar is your map to success that allows you and your team to “Focus on 1st things 1st” and exploit momentum to reach your goals and objectives.

Keys to planning your yearly calendar:

Know your Rhythms- all organizations have one

Establish all your key dates and target dates

Prepare both individually and with your team

Be willing to give margin in your space and time

Record unexpected events that occur for future planning

When planning both individually and with your team be willing to be imaginative. Consider your “Envisioned future” for the year and on key objectives and events. A great pleasure in life is doing what people say cannot be done. Don’t just…. look at things as they are - but as they can be. In the end there is no substitute for planning. “Plan your work – and work your plan.”

A Thanksgiving Suggestion

It’s the first of November and I am thinking about…..estate planning!

Actually, I am thinking about the dining room table after a wonderful Thanksgiving meal, and the conversation that ensues while family members are gathered around, pushing back from a satisfying culinary delight, and yes – they begin to talk about …estate planning!

Over the years, I have encouraged our clients to plan on mailing/emailing literature about the need to have a Will, or, charitable gift planning, or retirement plans, to their respective donors one week before Thanksgiving.

Why? It has been demonstrated, and in fact is widely known, that many of Arkansas’ financially well-to-do families gather together during the Thanksgiving holiday and discuss their year-end charitable giving.

And it makes sense – Thanksgiving is what I call a “clutter-less” holiday. By that I mean that unlike Christmas – which typically shares all the activities, gift giving, and Ho- Ho- Ho’s of my Aunt Siter’s famous “Ho Ho Pie,” the Thanksgiving holiday provides a bit of a respite from the frantic days which will undoubtedly follow, and allows for quiet, family conversations to take place.

That’s why having a strategically shared brochure on charitable gift plans, or planning one’s estate, can make its way to the dining room table for Mom and Dad to discuss openly and honestly their estate plans with their adult children.

While I would be happy to share my Aunt’s amazing “Ho Ho Pie” recipe with you (hint: there is a “bit” of brandy included in her recipe), I would encourage you to send to your donors information about Wills and other charitable gift planning techniques next week.

A Valentine’s Day Suggestion to Share with Development Officers….

“A Valentine’s Story….”

I would like to share an idea with you – this is a compassionate gesture which I have taken on for the past 35 years -- leading up to our forthcoming Valentine's Day 2022:

During each year, I keep a record/note of our client’s donors and friends whose male spouses have passed away during the year. As noted, and when appropriate, my wife, Pam, and I mail a Valentine’s Day card - which we sign - to each of these widows. This annual list is added to our existing current donors and friends listing who became widows in years past.

For over 35 years, we have conservatively mailed between 30 to 60 cards each year. In fact, I just visited our local Post Office earlier this week and purchased 40 "Valentine's Day" stamps in anticipation of our cards to be mailed next week.

Of course, I do not expect anything in return for this gesture; it is simply, to me, a ministry that I believe demonstrates our friendship and care for these gracious folks who are facing a lonely aspect or "emptiness" to their lives at this special time of year.

Over the years, and quite unexpectedly, we have received handwritten notes back from several of these gracious, caring folks. To my surprise, several have written to us not only to thank us for our card and handwritten note, but they have often stated that our’s was the only valentine they received – or perhaps, more succinctly – that they had family living nearby and no one shared a valentine greeting with them.

A small remembrance humbly shared as a “Thinking of You” gesture – it is a significant way to express to our donors and our friends that we care about them, and that they are an important part of our organizations, and, our lives.

I hope this is a suggestion that you may consider as you interact with your donors and friends this Valentine’s Day.

I would like to share an idea with you – this is a compassionate gesture which I have taken on for the past 35 years -- leading up to our forthcoming Valentine's Day 2022:

During each year, I keep a record/note of our client’s donors and friends whose male spouses have passed away during the year. As noted, and when appropriate, my wife, Pam, and I mail a Valentine’s Day card - which we sign - to each of these widows. This annual list is added to our existing current donors and friends listing who became widows in years past.

For over 35 years, we have conservatively mailed between 30 to 60 cards each year. In fact, I just visited our local Post Office earlier this week and purchased 40 "Valentine's Day" stamps in anticipation of our cards to be mailed next week.

Of course, I do not expect anything in return for this gesture; it is simply, to me, a ministry that I believe demonstrates our friendship and care for these gracious folks who are facing a lonely aspect or "emptiness" to their lives at this special time of year.

Over the years, and quite unexpectedly, we have received handwritten notes back from several of these gracious, caring folks. To my surprise, several have written to us not only to thank us for our card and handwritten note, but they have often stated that our’s was the only valentine they received – or perhaps, more succinctly – that they had family living nearby and no one shared a valentine greeting with them.

A small remembrance humbly shared as a “Thinking of You” gesture – it is a significant way to express to our donors and our friends that we care about them, and that they are an important part of our organizations, and, our lives.

I hope this is a suggestion that you may consider as you interact with your donors and friends this Valentine’s Day.